Frequently Asked Questions

If you have any additional questions or need further assistance, you can contact us at 360support@infosight360.com or fill out the the Support Request Form.

Yes! You can customize your My360 View! Just click on the "Customize" wheel in the upper right to choose which widgets you want included on your dashboard and use the widget dots to drag/drop them where you'd like to see them on your page.

This way, you have what YOU need when you login and see everything you need in one customizable view!

Our content team diligently monitors changes in laws and regulations and applies these changes to the content in a timely manner. The content team also considers NCUA guidance and industry best practices when developing and updating content. We typically conduct updates on a quarterly basis to accommodate not only the number of changing regulations, but the shorter time frame between the final ruling and the effective dates, in order to keep the model content as current as possible.

While every attempt has been made to provide accurate information, League InfoSight cannot be held accountable for any error or omission of the CU PolicyPro or RecoveryPro content. Please also keep in mind that the content is written from a federal law/regulation perspective and state and local law variations must be researched and incorporated as part of the credit union customization process. Contact 360support@infosight360.com if you have additional questions.

Yes, many credit unions use CU PolicyPro to manage their procedures.

The CU Policies area has the flexibility to organize content in hierarchical tiers, such as chapter, policy, and procedure. This allows for a more organized and structured approach to managing your content. The “Content Label” field allows you to specify the content type contained in each section (for instance Policy, Procedure, Appendix, etc)

The most common way of of incorporating procedures is to include them as a sub-section(s) under the overarching policy.

Alternate suggestions for adding procedures:

- Upload procedure documents to the “Resources” folder of the Files management system.

- Create a new chapter for sets of procedures.

Yes!

Create a subfolder specifically for board documents under the “Resources” folder in the Files area. Adjust the subfolder’s roles so that only board members (whatever user role(s) you use for board members) can access the folder and its contents. Then, upload your board packets/documents inside the subfolder. Members assigned to the role you chose will see this folder and its contents on the Resources page of the system.

Review the user guides for detailed instruction on uploading and securing documents for and assigning roles to users.

Yes, there is a processed called "publishing" which allows you to select any (or all)content from CU PolicyPro or RecoveryPro to be published into a printable document. Published documents can be downloaded to PDF (or Word) and stored externally from the site. Published documents can also be assigned to one or more Roles or to "Any Logged in CU PolicyPro/RecoveryPro User" which limits which users can see the document.

Please note that publishing is a point-in-time process, so once published the document content will not change. If your customized content is updated after being published, you will need to re-publish the document in order to see the changes.

Review the user guides for detailed instructions on publishing content.

Begin by reading through the User Guides, starting with Getting Started. The CU PolicyPro/RecoveryPro system is fairly intuitive and easy to use; however, a bit of training can go a long way to help you learn the easiest and most efficient ways to use the system.

Import just a few content sections at a time to CU Policies or CU BCP and complete the customization on those before importing additional content. This will keep the process manageable and not too overwhelming.

Yes. Please email 360support@infosight360.com to request a Vendor Information Package.

Yes, users are logged out after 8 hours of inactivity.

Note: It may not be apparent if you have been logged out. Your internet browser may allow you to continue entering content, but those changes will not be saved. If you have been inactive for several hours, we recommend refreshing the page to be sure you are still logged in.

Email our support team (360support@infosight360.com) and ask to be added to the newsletter distribution list. Please provide your name, email address, credit union, state, and job title in your email.

Files can be uploaded in the Files area (under Administration). Creating folders and uploading files under the “Resources” folder allows users to view those files in the Resources area of the system. Access roles can be assigned to the files and folders to limit viewing to specific users.

Note: In the Resources area there are folders for System Resources for each product which are managed by the support team. Credit union files cannot be added to these folders.

Review the user guides for detailed instructions on uploading and securing your own files.

There is significant subjectivity in determining how frequently credit union policies should be reviewed by the board of directors. The NCUA Examiner’s Guide recommends an annual review for all “major” policies; however, it does not define which policies are considered major.

The NCUA does have a Credit Union Policy Reviews webpage that identifies required policies and the mandatory review frequency (if applicable). However, many of the required policies listed on this page do not have a specific review frequency.

As a result, InfoSight360 has prepared a Policy List with Guidelines document that identifies mandatory policies. Our team recommends that you take a conservative approach, considering all mandatory policies as “major” and having them reviewed annually by the board of directors, unless a documented analysis supports a different review schedule.

Make sure you have tried refreshing the page and closing out of your browser and reopening it. After that, there are two possible issues.

First, check to make sure you created the folder under the “Resources” folder in the Files area. This is the only folder that is connected to the Resources page. “Files,” “Images,” and any other folders you create within the Files area are all still accessible from the Files area, but are not visible on the Resources page.

If you are not an Admin-level user, it is possible you do not have access to see the files on the Resources page. Users can be assigned a Role allowing access to the Files area, but will also need to be assigned to whatever Role was used to secure the folder/files.

Review the user guides for detailed instructions on uploading files to the “Resources” folder and assigning roles to the files/folders. access roles.

Once the purchase agreement has been submitted, our team will activate your RecoveryPro implementation and contact you to let you know it is ready. This may take up to 48 hours. At that time, any Admin-level users will have access to RecoveryPro. If you would like any non-Admin users to have access to RecoveryPro, you will need to adjust one of the roles they are currently assigned to, or you can create a new role with RecoveryPro rights and assign it as an additional role to the user.

For additional information, please see the "Set up users" area.

Some of the newer versions of Microsoft Word do not open the redlined version by default – you have to intentionally open the redline display. Once you have opened the redlined version, you should see a thin vertical line in the left margin (usually near the revised date) indicating a change. Click this vertical line and all redlined edits will display throughout the document.

If you have issues getting the redlined information to display, please contact the support team at 360support@infosight360.com.

There is a user-defined date field available for “Board Approved Date” for each content section which can be used to help keep track when the content was last reviewed.

Review the user guides for detailed instruction on updating the Board Approved Date.

Please send an email to 360support@infosight360.com to notify us of the name change and if your email has changed so we can ensure you receive information and updates related to CU PolicyPro and RecoveryPro.

- For email address changes, you will need to go into your account profile and update your own email address (in the Administration area, click the “My Account” link in the upper right corner of the screen). If you do not have access to the Administration area, any Admin-level user can update your email address for you or our support team will be happy to help. We do not update email address information unless specifically requested to do so as this will affect the user’s log in information.

- Any previously published documents will still have your old credit union name on them. The published documents are point-in-time, so there isn’t any way to update this. You will have to republish in order to see the new credit union name.

- Review the Key Fields and update the [CUname] Key Field, if applicable.

- If you have the credit union name as text in your customized policies (and not as a Key Field), you can use the search bar in the Administration area to see which sections include the credit union name and update accordingly.

CU PolicyPro model policy content includes a series of Key Fields to assist with the customization of the model policies. The bracketed text is a Key Fields, which is a bit of information needed to complete the customization of the content. An example of a key field would the name of the credit union, or the maximum amount allowable in a teller’s drawer.

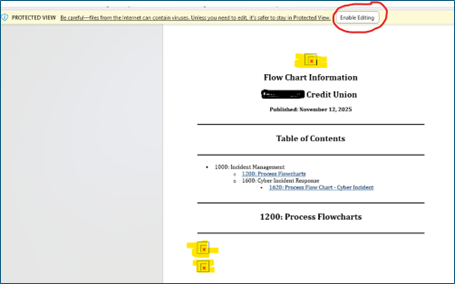

This is a Microsoft Word setting, not an IS360 issue. When you open the downloaded Word document, click “Enable Editing” at the top of the window. The graphics will then display correctly. Until editing is enabled, Word may block certain content like images for security reasons.

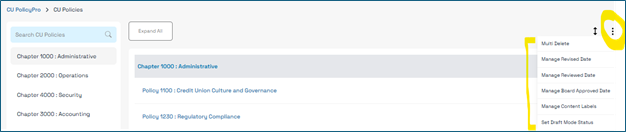

Yes! From the CU Policies or CU BCP listing, click the three-dot menu in the upper right corner. This opens a set of bulk management options that let you:

- Add dates to the Revised, Reviewed, or Board Approved fields across multiple content sections

- Delete multiple sections of content at once

- Manage content labels for several sections simultaneously

- Set multiple sections to DRAFT mode or remove them from DRAFT mode

Our recommendation is to use the Revised Date for documenting changes made to your content, the Reviewed Date to document your internal review (even if no changes are made), and Board Approved Date to document the Board's review of the policy (even if no changes are made). Board members are expected to review "major" policies on an annual basis, so your examiners will be looking specifically for the Board Approved Date, which should coincide with your documented meeting minutes.

We recommend utilizing the Auditing Notes when editing content to create a history of customization and changes to the content.

Each content section has Auditing Notes available below the content editor. These notes can be used to document what has been customized or to document who made certain updates or changes. Credit unions often use this documentation to determine how much custom content is included in any given content section versus the use of the model content.

The Activity Log details when content was imported/created, deleted, restored, or saved, and which user performed these actions, however, the activity log does not document specific changes made to the content. Auditing Notes are the best way to document details of changes to the content.

Review the user guides for detailed instruction for detailed instructions on using Auditing Notes and the Activity Log.

If a policy is “Mandatory,” there is a requirement for the credit union to have a written policy to follow for that topic.

If a policy is “Compliance Mandatory,” the credit union is not required to have a written policy, but are required to follow whatever any laws/regulations for that particular topic. Compliance Mandatory policies are provided to help credit unions understand what is required by the law/regulation. The requirements written in a policy format that is familiar to credit unions.

A revised date shows the last time the content was changed or updated.

A reviewed date indicates that the content has changed, been reviewed.

The reviewed and revised dates may be the same date, or the revised date may be prior to the review date, indicating the content was reviewed but did not need a revision.

There are several policies that are specifically mentioned or required by regulation or regulator guidance (if your credit union provides the service, program, or product).

The Policy List with Guidelines will give you guidance on whether the model policy is mandatory, mandatory if offered, optional, recommended, etc. This document can also be found in the Resources area under CU PolicyPro System Resources > System Tools.

While any access rights can be assigned to a board member, many credit unions opt to create board member user profiles with User-Level access, then create and assign the Role of “Board Member” to each person. The Board Member role typically is very minimal and generally only includes CUPP Limited and/or RP Limited access. Board members will see only published manuals and uploaded files assigned to the “Board Member” or “Any Logged in CUPP/RP User” roles.

Review the user guides for detailed instructions on creating users and managing user access. I am an Admin-level user. Can I change my own access level?

Yes, you can. However, make sure that at least one other person is an Admin-level user before changing your access level. Only Admin-level users can add and manage other users, so you don’t want to leave your credit union without any Admin-level users.

The “recommended” designation means there is no law or regulation that requires the policy or update, but it is still recommended because examiners will want to see it. This is often based on letters to credit unions or Interagency Guidance that don’t have the force of regulation. Credit unions are free to disregard this advice and omit the recommended verbiage, but it will likely appear on an exam report that a credit union doesn’t have this information in a given policy.

Some firewalls will prevent automated emails from getting through unless the domain is whitelisted, so we recommend whitelisting @infosight360.com, the email domain from which our system emails will originate. If you do not receive your password reset email within 10 minutes of requesting it, please contact our support team at 360support@infosight360.com and we can manually reset the password.

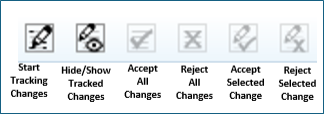

The Track Changes feature works differently than in MS Word. To fully turn it off, you must first accept or reject all changes, otherwise, the system continues to track edits.

You may be using the Hide/Show Tracked Changes feature, which only hides changes temporarily for review; however, it does not accept or reject those changes. Some users have engaged the Hide/Show Tracked Changes button thinking it disables tracking, and are confused with the redlines reappear when reopening the policy.

To resolve this:

- Use Accept or Reject options to determine how each change will be handled.

- Click the Start/Stop Tracking Changes button to turn tracking off.

Note: If redlines are active, they will appear in printed or published versions. Many credit unions use this to show proposed edits to boards, executives, or examiners.

There are a few instances where a password change is required:

- As a security measure, passwords are required to change every 90 days.

- When our support team creates a new user or resets a password for an existing user, a temporary password is used and the user will be required to change the password on the next login.

- If the “Forgotten Password” function is utilized, the system will ask the user to change their password on the next login.

If the system is asking you to change your password outside of these reasons, please contact 360support@infosight360.com.